Pay out:

More!

More!

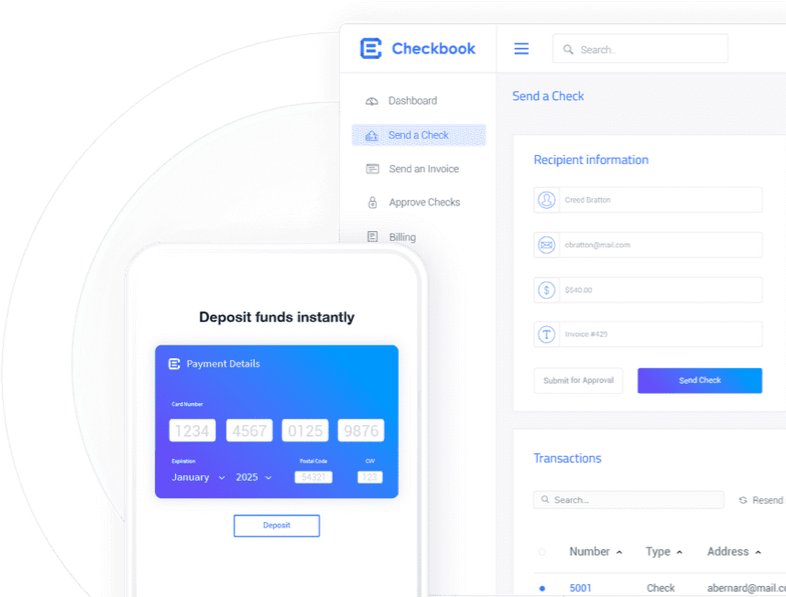

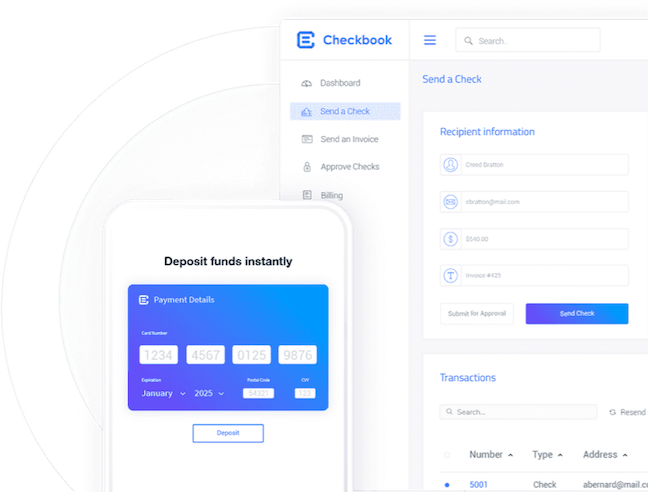

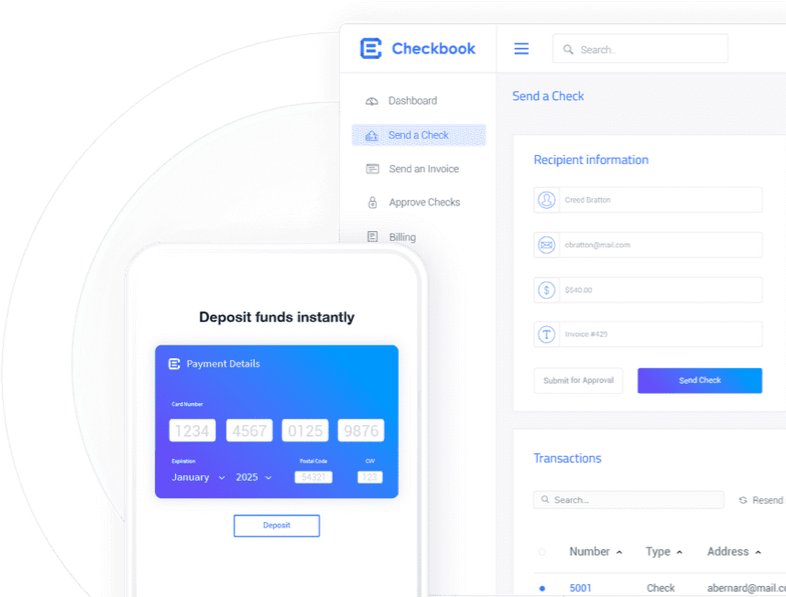

Your payment platform doesn't need to be complicated. See how Checkbook brings flexibility to the entire payment experiences - for you and your customers.

Stop keeping track of everyone’s financial information. All we need is one of the following, and we’ll handle the rest.

Eliminate scattered payment methods and accounting headaches.

A single dashboard to track every payment

Save money with easy-to-understand pricing plans geared to your needs.

Send quick and hassle-free bulk payments without the delays

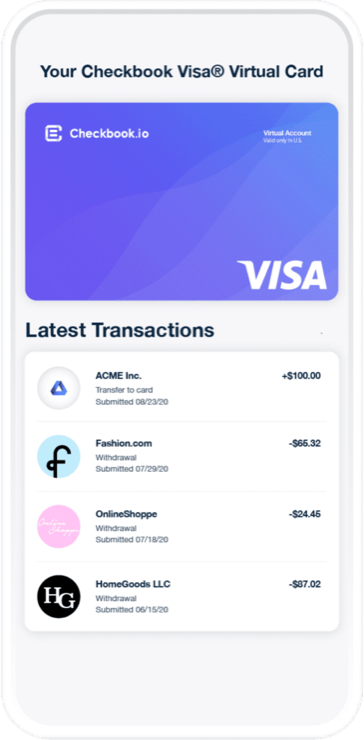

Never worry about making anyone wait for their money.

White label service sends your payments from you, not Checkbook

Pay them the way they want to be paid.

No. Checkbook does not charge percentage-based fees. No matter how large the payment is, the cost remains the same.

The headline and subheader tells us what you're offering, and the form header closes the deal. Over here you can explain why your offer is so great it's worth filling out a form for.

Remember:

No. Checkbook does not charge percentage-based fees. No matter how large the payment is, the cost remains the same.